Afreximbank and Woodhall Capital partner on Supply Chain Finance and Factoring in Nigeria. As key players in financial advisory services and facilitating international funding, Woodhall core expertise is bridging the gap between clients and international financial markets, thus enabling the execution of bilateral and multilateral agreements.

Supply chain Finance enables suppliers to access financing from the bank by obtaining early payments for invoices which have been approved for payment by their corporate buyers. The buyers continue to receive trade credit from the suppliers, and the suppliers finance their working capital through the early payment received, enabling them to grow their business. The financing cost is linked to the credit rating of the corporate buyers, thereby making this product particularly valuable for SME suppliers who may face challenges in accessing finance at competitive pricing.

Woodhall Capital identified supply chain finance as a solution for improving access to trade finance in Africa and embarked on a journey to increase penetration through financial intervention and capacity building.

The workshop had in attendance corporates, financial institutions and sovereigns; including the Governor of the Central Bank of Nigeria, Dr Olayemi Cardoso, who was represented by the Deputy Director of the Other Financial Institutions, Supervision Department, Mr Abayomi Arogundade, emphasized the workshop’s role in establishing regulatory frameworks for factoring; Lagos State Commissioner for Trade and Investment, Mrs Folasade Ambrose-Medebem and other stakeholders.

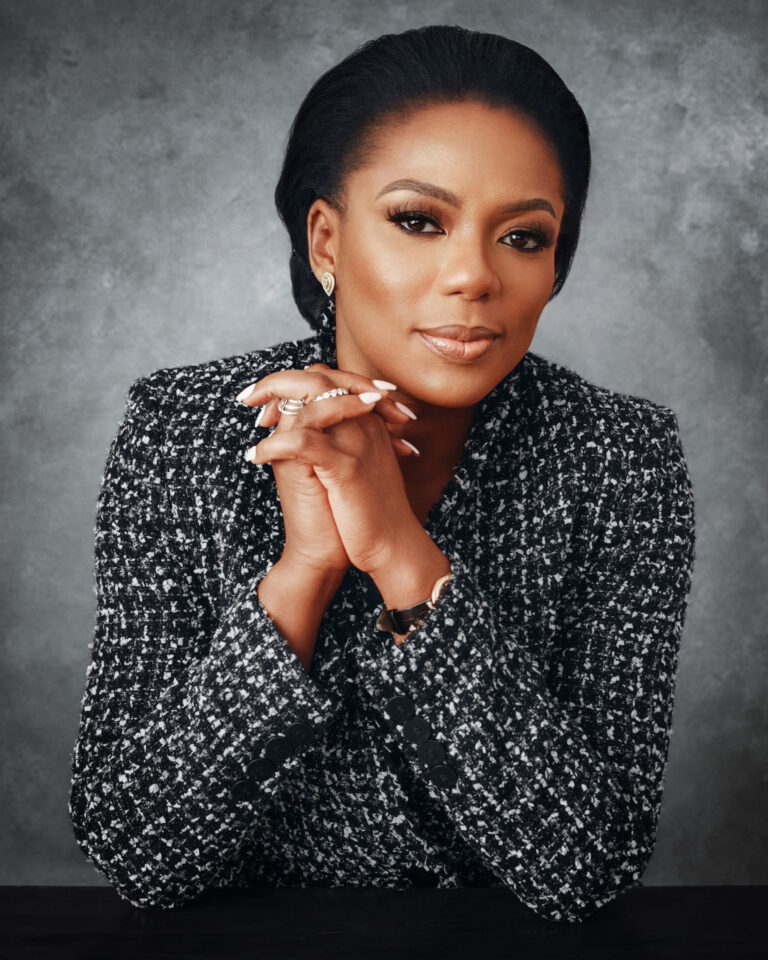

Mrs. Mojisola Hunponu-Wusu, founder of Woodhall Capital, corroborated the CBN’s stance, noting that the financial institutions had shown unwavering support for supply chain finance, which had catalysed its visible growth.

Participants engaged in insightful panel discussions, sharing expertise and strategies to navigate the evolving landscape of Supply Chain Finance. From identifying innovative financing solutions to addressing regulatory considerations, the workshop provided valuable insights for attendees to enhance their operations and seize new opportunities in the marketplace.

The workshop served as a platform to explore the opportunities and challenges within the payables finance industry in Africa’s biggest economy and for corporates and banks to gain insights into the benefits and applications of supply chain finance and factoring.

"Supply Chain Finance boosts SME growth by unlocking early payments and improving access to competitive financing. Woodhall Capital is driving financial inclusion in Africa through targeted interventions and capacity building. #TradeFinance #SMEgrowth #WoodhallCapital"